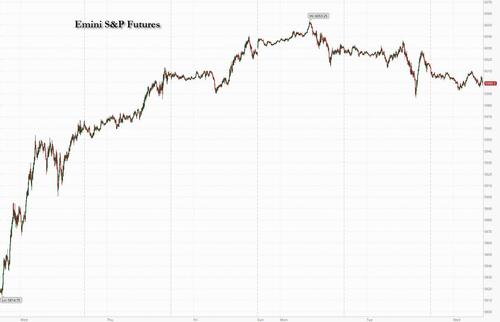

US equity futures, and global markets dropped for the second day in a row on Wednesday as rising yields and a stronger dollar dented the euphoric sentiment behind the Trump rally, and as investors awaited key US inflation data amid concerns that Trump’s proposed America-First policies will reignite price growth. As of 8:00am S&P500 futures and Nasdaq 100 futures slipped 0.2% into the CPI print which is expected to rise for the fourth month (full preview here). Pre-mkt, Mag7 is mixed, and semis are lower; Banks, Energy, Industrials, and Healhcare are seeing a bid. Treasuries steadied after a renewed selloff Tuesday while the dollar was flat after earlier rising beyond 155 per dollar for the first time since July, raising the risk that Japan will intervene to slow the depreciation; the EURUSD briefly dropped to 1.0594 the lowest in a year. Commodities are higher led by Energy and Precious Metals. CPI and five Fed speakers are the macro focus for today as the earnings calendar thins out.

In premarket trading, Cava Group surged 15% after the Mediterranean restaurant chain increased its annual projections for comparable sales. Chegg tumbles 15% after the education technology company gave a fourth-quarter forecast that was weaker than expected. Tesla (TSLA) gains 1.6% and Roivant (ROIV) rises 3% after President-elect Donald Trump picked billionaire Elon Musk and entrepreneur Vivek Ramaswamy to lead a new department that will aim to make the government more efficient. Here are some other notable premarket movers:

According to Bloomberg, traders are adding inflation hedges and pricing in fewer interest-rate cuts next year amid the threat that Trump’s pro-growth agenda could unleash price pressures. Today’s US data is expected to show the overall consumer price index rose by 0.2% for a fourth month.

“We’ve been pouring our way into long-dated inflation linked bonds in the US where I see the inflation risk as the highest,” Freddie Lait, managing partner at Latitude Investment Management in London, said in an interview with Bloomberg TV. “I would look at the Trump win and think that became more likely.”

The president elect’s anti-trade stance is already taking a toll on assets in the developing world. An MSCI gauge of equities excluding the US is posting its worst day in three months, while an index of emerging market currencies is close to erasing this year’s gains. China’s yuan hit a three-month low Tuesday, forcing authorities to set the currency’s reference rate higher.

European stocks are flat in early trading Wednesday, pausing after a selloff in the previous session; the Stoxx 600 is flat at 502.01. Siemens Energy and Just Eat Takeaway both rose more than 20%. Smiths Group and Dowlais rallied by a similiar amount before paring the surge. Here are the biggest movers Wednesday:

Earlier in the session, Asian equities slumped again, headed for their lowest close since September, amid continued selling in the region’s technology stocks. The MSCI Asia Pacific Index declined as much as 1.3%, with TSMC and Samsung Electronics the biggest laggards. A guage of the region’s technology stocks fell as much as 1.4%. The region’s stocks tracked US peers lower after Treasury yields spiked ahead of data expected to show an uneven path of easing consumer price pressures. South Korea led losses in the region as global funds sold shares in companies that are vulnerable to Trump’s protectionist trade policy. Benchmarks in India, Japan, Australia and Taiwan also declined. Stocks in China were volatile before closing higher. The onshore CSI 300 index rose 0.6%, while a gauge of Chinese shares listed in Hong Kong erased a drop of as much as 1.3% to close little changed. Worries over an escalating trade war with the US and China’s unclear prospects for recovery remain as headwinds for investors.

In FX, a gauge of the dollar was little changed Wednesday near two-year highs. Dollar strength has pushed the yen beyond 155 per dollar for the first time since July, raising the risk that Japan will intervene to slow the depreciation. The EURUSD briefly dropped to a new one-year low below 1.06 before rebounding.

In rates, treasuries staged a minor rebound from Tuesday’s sharp selloff ahead of key US inflation data due later on Wednesday. US 10-year yields fall 1 bp to 4.41%. That’s put the brakes on the recent dollar rally with the Bloomberg Dollar Spot Index near flat. Yields are 1bp-2bp richer on the day from belly to long-end with front-end little changed, flattening 2s10s spread by ~2bp; it steepened 3.5bp in Tuesday’s selloff. The 10-year yield around 4.42% is less than 2bp richer on the day, outperforming bunds and gilts in the sector by 4bp and 3bp. Treasuries have been pummeled by the prospect that Trump’s vowed policies, like tax cuts and tariffs, could fuel price pressures and force the Federal Reserve to keep rates elevated. Traders are pricing in just over a 50% chance of another quarter-point cut in December, after yields on two- and five-year Treasuries surged to their highest levels since July.

In commodities oil prices advance, with WTI rising 0.7% to $68.60 a barrel. Spot gold climbs $9 to $2,608/oz.

Bitcoin fell 1% after a chart-busting rally took the digital asset to almost $90,000.

Looking at today's event calendar, US economic data calendar includes October CPI (8:30am) and federal budget balance (2pm). The Fed speaker slate includes Kashkari (8:30am), Williams (9:30am), Logan (9:45am), Musalem (1pm) and Schmid (1:30pm)

Market Snapshot

Top Overnight News

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mostly subdued following the negative lead from the US amid higher yields and cautiousness ahead of US CPI data, while the region also digested a slew of earnings releases. ASX 200 was dragged lower by underperformance in the mining-related stocks and with the top-weighted financial industry also pressured in the aftermath of CBA's earnings which posted a flat Y/Y cash profit of AUD 2.5bln for Q1. Nikkei 225 retreated following the hotter-than-expected PPI data, while losses were initially stemmed by recent currency weakness and with Sharp and Tokyo Electron among the best performers post-earnings, although selling eventually worsened. Hang Seng and Shanghai Comp were mixed amid light catalysts and as participants await Chinese tech earnings, while US President-elect Trump's first picks for his administration included China hawks such as Waltz, Rubio and Lighthizer, although he also named China-friendly Elon Musk to lead the department of government efficiency with Vivek Ramaswamy.

Top Asian News

European bourses, Stoxx 600 (+0.2%) initially opened very modestly lower across the board, in a continuation of the subdued price action seen in Asia overnight. However, sentiment soon improved just after the cash open to display a more positive picture in Europe. European sectors are mixed, having initially opened with a slight negative bias. Energy takes the top spot, lifted by significant gains in Siemens Energy after it raised its mid-term targets; gains in oil prices in recent trade may also be propping up the sector. Basic Resources follows closely behind, attempting to pare back some of the prior day’s losses. Tech is found at the foot of the pile. US Equity Futures are very modestly lower across the board, with price action tentative ahead of US CPI.

Top European News

FX

Fixed Income

Commodities

Geopolitics: Middle East

Geopolitics: Other

S Event Calendar

Central Bank Speakers

DB's Jim Reid concludes the overnight wrap

The inspiration for the report is that we’re now within touching distance of completing the first quarter century (QC) of this millennium (assuming our definition), so we thought we’d review what’s happened since the end of 1999 and what we can learn from it across economic data, asset price returns, and crucial factors like demographics. Yesterday's CoTD from the report showed how in early 2000 the CBO expected all US government debt to be paid back by 2013 at the latest with 2025 still having zero debt/GDP. We'll start the new quarter century in 2025 with $28 trillion more debt than expected back then and nearer to 100% of GDP. It shows how quickly the narrative can change. See the full report for much, much more.

Talking of debt, Treasury yields surged yesterday as the market continues to try to come to terms with the implications of the US election result that was emerging exactly a week ago as I type. This is all ahead of today's US CPI which will be a key factor in the Fed’s decision next month. That’s particularly important this time around, as there’s been speculation the Fed might skip this meeting and not cut at all, with futures only pricing in a 59% chance of another cut next month. However Minneapolis Fed’s Kashkari, one of the more hawkish FOMC voices, did suggest a still reasonably high bar for the Fed to pause next month, saying that “there’d have to be a surprise on the inflation front to change the outlook so dramatically”.

Nevertheless, the December 2025 Fed futures contract was up another +6.0bps to 3.88% yesterday. In turn, that led to a clear run-up in Treasury yields, and the 2yr yield (+8.7bps) reached its highest since July at 4.34%, whilst the 10yr yield was up +12.4bps to 4.44%. That repricing also led to a fresh move up for the dollar index (+0.46%), which closed at its highest level since June. But that meant it was a different story elsewhere, with the Euro down to a one-year low of $1.0607, and sterling fell to a 3-month low of $1.2733.

With regards to today's US CPI, the backdrop is that last month's core CPI print was the strongest in 6 months, at +0.31% so there may be another upside surprise from a pause in December. In terms of what to expect, our US economists think that core CPI will tick down a bit from last month to +0.26%, which would keep the year-on-year reading at 3.3%. For headline inflation, they expect that to be at +0.20%, with the year-on-year reading up a tenth to +2.5%. Click here for our economist’s full preview and how to register for their subsequent webinar.

Back to yesterday and while yields and the dollar resumed their march higher, several other “Trump trades” struggled. Tesla was down -6.10%, while Trump Media & Technology Group was itself down -8.80%. Small-caps struggled as the Russell 2000 (-1.77%) saw its weakest day in two months, while the KBW Bank index retreated by -0.52%. More broadly, the S&P 500 was down -0.29%, the first decline in six days, but the declines were fairly broad, and the equal-weighted version of the index was down by a larger -0.77%. Big tech helped limit the extent of the headline decline, as aside from Tesla’s reversal the Mag-7 saw average gains of nearly 1%, led by Nvidia (+2.10%).

Over in Europe, the main news came from Germany, where the political parties agreed to hold an early federal election on February 23. So Chancellor Scholz will table a confidence vote on December 16, and once that’s lost the President is able to hold early elections. That’s a change from the timetable that had previously been proposed, which was for a confidence vote on January 15, and then elections in March. As it stands, opinion polls have consistently placed the centre-right CDU/CSU group in the lead, with Politico’s polling average putting them on 32%. They’re followed by the far-right AfD on 17%, Chancellor Scholz’s centre-left SPD on 16%, the Greens on 10%, and the new far-left group BSW on 8%. Then behind them are the FDP on 4%, and the Left on 3%, both of whom are beneath the 5% hurdle required to enter the Bundestag.

Markets slumped across the continent, with the STOXX 600 (-1.98%) posting its worst daily performance since the market turmoil back in early August. The declines were very broad-based, and other indices posted even sharper losses, including the CAC 40 (-2.69%) and the DAX (-2.13%). External uncertainty weighed on sentiment with Stoxx luxury (-3.58%) and industrials (-2.68%) indices seeing sizeable declines, while materials stocks (-2.91%) also underperformed as the Bloomberg Industrial Metals index fell to its lowest since mid-September. Perhaps a weak session in China contributed. Moreover, there was little respite on the rates side, with yields on 10yr bunds (+3.5bps), OATs (+4.0bps) and BTPs (+4.6bps) all moving higher.

Meanwhile in the UK, gilts underperformed after data showed that wage growth was stronger than expected in September. For instance, average weekly earnings over the 3m to September were up +4.3% compared to the previous year (vs. +3.9% expected). That led investors to dial back the chance of rate cuts from the Bank of England, with just 51bps of cuts now priced in by the August 2025 meeting, down -8.6bps on the day. And in turn, yields on 10yr gilts were up +7.4bps to 4.50%, a larger rise compared to the rest of Europe.

Asian equity markets are continuing to decline overnight on the general uncertainty post the election.

The KOSPI (-2.22%) is the biggest underperformer, pulled lower by the index heavyweight Samsung Electronics (-3.40%) as it declines for the fourth consecutive session, reaching its lowest level in over four years. Elsewhere, the Nikkei (-1.84%) is also trading noticeably lower as wholesale inflation reached its highest level since August of last year (more below) with the Hang Seng (-0.91%) and the S&P/ASX 200 (-0.75%) also trading in negative territory. The Shanghai Composite (-0.14%) is outperforming.

Moving back to Japan, the producer price index (PPI) rose +3.4% from the same month last year (v/s +2.9% expected) as a spike in rice costs pushed up overall wholesale inflation. That compares to an upwardly revised +3.1% increase in September.

In FX, the Japanese yen (-0.15%) continues to remain on the backfoot for the third consecutive session, trading at 154.86 against the dollar, the lowest since July 29 amid growing market conviction that Japan's political landscape could make it difficult for the BOJ to hike interest rates again. DB's Francis Yared thinks the opposite and believes the US election result and domestic Japanese wages opens the door to higher front end Japanese rates than the market expects.

On the data front yesterday, the highlight in the US was the Fed’s quarterly Senior Loan Officer Survey (SLOOS), which showed aggregate bank credit conditions staying at around neutral levels. The SLOOS showed further normalisation of credit standards for CRE lending, while banks’ willingness to make consumer loans turned positive for the first time in two years. But the positive credit cycle read through was offset by a renewed decline in demand for C&I lending and a tightening in mortgage standards.

Looking at yesterday’s other data, the German ZEW survey came in beneath expectations, with the current situation down to -91.4 in November (vs. -85.0 expected). That’s the lowest reading since May 2020 during the Covid-19 pandemic. Moreover, the expectations component fell back to 7.4 (vs. 13.2 expected). Otherwise, the NFIB’s small business optimism index was out in the US, which rose to 93.7 in October (vs. 92.0 expected).

To the day ahead, and the main data release will be the US CPI report for October. Otherwise, central bank speakers include the Fed’s Kashkari, Williams, Logan, Musalem and Schmid, along with the BoE’s Mann.

Source link