US equity futures are higher as traders hoped earnings from Nvidia after the close would unleash fresh buying momentum and wash away the bitter taste from Target's catastrophic earnings this morning. As of 8:00am S&P futures rose 0.2% as small caps lagged after Wall Street benchmarks recovered from a bout of volatility following the escalation in Russia’s war against Ukraine; Nasdaq futures also rose 0.2% with Mag 7 stock mixed premarket and led by MSFT (+0.6%) and NVDA (+0.5%). Sentiment was also boosted after Putin said he was open to discussing a ceasefire deal with Trump, but is ruling out any territorial concessions (Moscow would freeze the conflict along the present battlelines) and wants a guarantee that Ukraine won’t join NATO. Bloomberg’s dollar gauge rose 0.3%, rebounding from a three-day drop. The 10-year US Treasury yield climbed three basis points after falling yesterday as investors fled to haven assets. On Commodities, oil and base metals are higher while precious metals are lower; Bitcoin is back to all time highs just around $94,000. All eyes on NVDA earnings after market close. Expectations remain higher with crowding positioning (more in our preview later). JPM's TMT specialist Josh Meyers says that that “a nice beat seems widely anticipated tomorrow, with expectations for the guide starting at $38b and going up a bit from there”, but Goldman's trading desk is more cautious warning that all the good news may already be in the priced-to-perfection stock.

In premarket trading, retailer Target promptly reversed all the goodwill from yesterday's blowout Walmart earnings and crashed as much as 20% after the it trimmed its full-year outlook due to flat sales and an inventory buildup. Company executives said US consumers spent less on nonessential items such as clothes and home products - a weaker third-quarter picture than the one provided by Walmart Inc. on Tuesday. Here are some other notable premarket movers:

Investors will scrutinize Nvidia’s quarterly results to gauge if the world’s most valuable company can continue its remarkable run fueled by spending on artificial intelligence hardware, with the chipmaker edging higher in premarket trading after rising 4.9% in the previous session. Trading in options signals the results will be the most important catalyst left this year — more than the Federal Reserve’s December meeting, according to Barclays Plc strategists.

"The health of the market being driven by results of individual companies in itself points to a certain element of fragility," said Subitha Subramaniam, chief economist at Sarasin & Partners. “Is it sufficient that they beat, is it sufficient that they beat by a big margin? We are hanging on every statement of the CEO.”

Traders will also monitor Donald Trump’s administration picks, especially his selection for the Treasury secretary role. Former Federal Reserve Governor Kevin Warsh and Apollo Global Management’s Marc Rowan are in contention, with the FT reporting that the Apollo boss has emerged as the top contender. Meanwhile, Trump tapped Cantor Fitzgerald CEO Howard Lutnick to lead the Commerce Department, a key role to facilitate his tariff and trade policies.

“As I look at the Treasury secretary race, I want to see exactly who is in that role because the tax policies, the debt limit all come back,” Ed Mills, Washington policy analyst at Raymond James, told Bloomberg TV. “We need to see exactly how that person has a relationship with the Federal Reserve, because monetary policy will quickly figure into all of this.”

Europe’s Stoxx 600 reversed Tuesday’s fall with the Stoxx 600 up 0.6% as reports suggest Putin is willing to talk with US President-elect Trump about a cease-fire deal in Ukraine; mining, technology and construction shares lead gains. The UK's FTSE 100 underperformed after the latest inflation reading came in hotter than anticipated, with traders paring back expectations for Bank of England rate cuts. Among individual movers in Europe, Sage Group Plc was up as much as 22%, the biggest intraday gain on record, after the software firm announced a £400 million ($507 million) buyback and reported stronger revenues. La Française de Jeux SAEM shares fell as much as 6.9%, the biggest drop in seven weeks, after a shareholder sold 4.7 million shares in the gaming equipment company at a discount. Here are all the notable European movers:

Earlier in the session, Asian equities retreated as traders awaited Nvidia’s earnings and forecasts to gauge if spending on artificial intelligence hardware will remain strong. The MSCI Asia Pacific Index dipped 0.5% after advancing 1% in the previous session. Gains in Hong Kong, mainland China and South Korea were offset by weakness in Taiwan and Japan. Across the region, technology stocks weighed on the benchmark most, followed by financial shares.

In FX, the pound erased its post-CPI gains as dollar strength takes over. The Bloomberg Dollar Spot Index rises 0.4%. The yen is the weakest of the G-10 currencies, falling 0.7% to around 155.80 against the greenback.

“The pound was last week’s underperformer, so it does at least have some scope to reverse some of that move” with the dollar having lost momentum, said Stuart Bennett, head of G10 currency strategy at Santander CIB. “If risk improves and the market gets carried away by the data alone, last Wednesday’s high at 1.2768 looks possible for cable, but it will depend on the US dollar and risk”

In rates, treasury futures held losses accumulated during London morning, led by gilts after UK inflation quickened more than expected in October. Meanwhile, haven demand that supported Treasuries Tuesday has ebbed since reports that Russia’s Putin is open to discussing a cease-fire in Ukraine with US President-elect Trump. US yields are 2bp-3bp cheaper across a slightly steeper curve; 10-year around 4.425%, about 2.5bp higher on the day, outperforms gilts in the sector by 3bp, bunds by 1.5bp. Gilts lead a selloff in European government bonds after UK inflation accelerated more than forecast in October, prompting traders to trim bets on the Bank of England’s interest-rate cuts path. UK 10-year yields rise 5 bps to 4.49%. US session includes 20-year bond auction at 1pm New York time; the new issue has a WI yield around 4.68%, about 9bp cheaper than last month’s auction result

In commodities, oil prices rise for a third day. Spot gold falls $6 to $2,626/oz. Bitcoin rises 1% to above $93,000.

Bitcoin rises to another all-time high, rising more than 2% above $94,000 supported by a series of developments highlighting the deepening embrace of the digital-asset industry in the US under crypto cheerleader Trump.

The US economic data calendar is blank, while Fed speaker slate includes Barr (10am), Cook (11am), Bowman (12:15pm) and Collins (4pm).

Market Snapshot

Top Overnight News

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mixed following the price swings seen across global markets on Tuesday in which the US indices staged a recovery from the initial risk-off conditions triggered by the Ukraine-Russia escalation, while participants now await NVIDIA's earnings. ASX 200 pulled back from recent record highs but with losses contained by a quiet calendar and light macro newsflow. Nikkei 225 traded indecisively despite the mostly better-than-expected Japanese trade data, while there were firm gains seen in Seven & I Holdings and media powerhouse Kadokawa following respective M&A-related headlines. Hang Seng and Shanghai Comp swung between gains and losses with price action indecisive following the lack of fresh major catalysts in the region, while there were also no surprises from the PBoC's announcement of the benchmark Loan Prime Rates which were maintained at their current levels following last month's 25bp cuts.

Top Asian News

European bourses opened the session entirely in the green and have generally traversed best levels throughout the morning. European sectors hold a strong positive bias, with only a couple of sectors found in negative territory. The breadth of the market to the upside is fairly narrow, with no clear outperformer. Construction & Materials tops the pile, joined by Tech and then Basic Resources; the latter pair buoyed by the positive risk tone. Real Estate is found at the foot of the pile, given the relatively higher yield environment. US equity futures (ES +0.2%, NQ +0.2%, RTY +0.2%) are modestly firmer across the board, attempting to build on the prior day’s gains and as traders remain laser-focused on NVIDIA (+0.3% pre-market) results after-hours.

Top European News

FX

Fixed Income

Commodities

Geopolitics: Middle East

Geopolitics: Ukraine

US Event Calendar

Central Banks

DB's Jim Reid concludes the overnight wrap

Welcome to Nvidia's quarterly earnings day. They report after the bell in what is likely to be the biggest event of the week. With a market cap of $3.61tn and nearly as big as the entire DAX and CAC combined, it's going to be a big event. To give you a scale for their astonishing earnings trajectory over such a short period of time, at the recent lows in Jan 2023 Nvidia earned $4.4bn over the preceded last 12m. However, today the consensus will see them earn $61.4bn over the last 12 months. Then, by the time we hit 2027, they are expected to earn $118.1bn LTM. There has never been a large cap company like it in the history of financial markets. Last quarter, the revenue outperformance was the smallest relative to expectations in six quarters, so it wasn’t the sort of massive beat that Nvidia has often reported over the last couple of years. And in turn, their share price was down -6.38% the following day. However, since then, the share price is up around 20%, so no lasting damage was done.

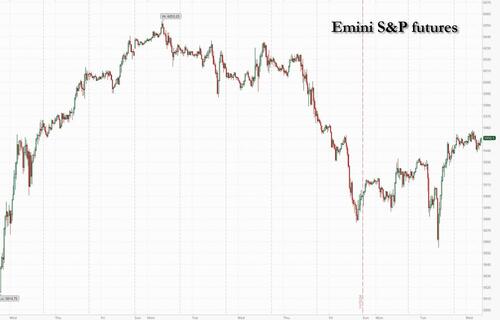

The anticipation of this event seemed to pull markets up from their early geopolitical worries with the S&P 500 closing +0.40%, after S&P futures were down more than -1% shortly before the US open. It was a similar story for bonds, as the 10yr bund yield was initially down more than -10bps, before paring that back to just -3.4bps by the close.

The initial slump began thanks to fears of an escalation in the Russia-Ukraine conflict. Specifically, Ukraine made its first US-sourced ATACMS strike inside Russia, and President Putin signed a revision to Russia’s nuclear doctrine, allowing for a wider set of conditions under which they could use nuclear weapons.

The escalation news immediately led to a significant move into perceived safe havens, with assets like gold, sovereign bonds and the Japanese Yen all advancing. In addition, European equities were hit across the board, and the DAX was down -1.96% at its intraday low (-0.67% at the close).

But after those early losses, markets began to recover as the focus turned to Nvidia’s results. Leading up to the release, Nvidia (+4.89%) posted a strong gain yesterday, making it the top performer among the Magnificent 7 (+1.76%). That helped to lift equities more broadly, with the S&P 500 (+0.40%) managing to post a decent gain. Nevertheless, many stocks didn’t perform so well, and the equal-weighted S&P 500 was down -0.26%, which showed again how the Magnificent 7 were single-handedly driving the broader market. Meanwhile in Europe, there was a much stronger underperformance given the geopolitical developments. For instance, the STOXX 600 (-0.45%) posted a third consecutive loss, which took the index down to a 3-month low.

For sovereign bonds, there were modest gains on both sides of the Atlantic amid the broader geopolitical fears, though the rally eased off as the day went on. The 2yr Treasury yield traded as much as -7bps lower early on before closing virtually flat on the day (+0.1bps), whilst the 10yr yield fell by -1.8bps to 4.40% after earlier trading as low as 4.34%.

Over in Europe, sovereign bonds rallied across the board, with yields on 10yr bunds (-3.4bps), OATs (-2.0bps) and BTPs (-1.7bps) all moving lower. Alongside the geopolitical fears that drove the initial moves, we also had some dovish comments from the ECB’s Panetta, the Italian central bank governor. He said that “restrictive monetary conditions are no longer necessary”, and that they needed to “normalize our monetary-policy stance and move to neutral – or even expansionary territory, if necessary.”

Elsewhere in the political sphere, there’s still no confirmation of who the next US Treasury Secretary will be. The speculation so far this week has increasingly centred around former Fed Governor Kevin Warsh, although others including Scott Bessent and Apollo CEO Mark Rowan have also been widely reported as candidates with Rowan rapidly moving up the pecking order on Polymarket.com. It's all changing hour by hour. One name that had reportedly been in contention was Howard Lutnick, but yesterday it was confirmed that Lutnick had been selected as Trump’s nominee for Commerce Secretary.

Asian equity markets are trading in a relatively tight range this morning with the S&P/ASX 200 (-0.57%), the Nikkei (-0.28%) and the Hang Seng (-0.06%) are edging lower while the KOSPI (+0.58%), and the Shanghai Composite (+0.46%) are higher. US stock futures are up around a tenth of a percent.

Early morning data showed that Japan’s exports rebounded +3.1% y/y in October (v/s +1.0% expected), led by strong growth in the shipment of chip making equipment. It followed the prior month’s decline of -1.7%, which marked a 43-month low. Meanwhile, imports climbed +0.4%, compared with a -1.9% decline forecast by economists (v/s +1.8% in September). At the same time, the trade deficit widened to -¥461.2 billion from -¥294.1 billion.

In monetary policy action, the People’s Bank of China (PBOC) kept the 1-yr and 5-yr loan prime rate (LPR) intact at 3.1% and 3.6%, respectively, as Beijing continues to assess the effects of its recent stimulus measures.

There wasn’t too much data yesterday, although Canada’s CPI for October was a bit higher than expected at +2.0% (vs. +1.9% expected). Otherwise, US housing starts and building permits were both somewhat beneath expectations in October, with housing starts at an annualised pace of 1.311m (vs. 1.334m expected).

To the day ahead, and the main highlight will be Nvidia’s earnings results after the US close. Otherwise, data releases include the UK CPI report for October as we go to print. Lastly, central bank speakers include the Fed’s Barr, Cook, Bowman and Collins, the ECB’s de Guindos, Stournaras and Makhlouf, and the BoE’s Ramsden.

Source link