Submitted by QTR's Fringe Finance

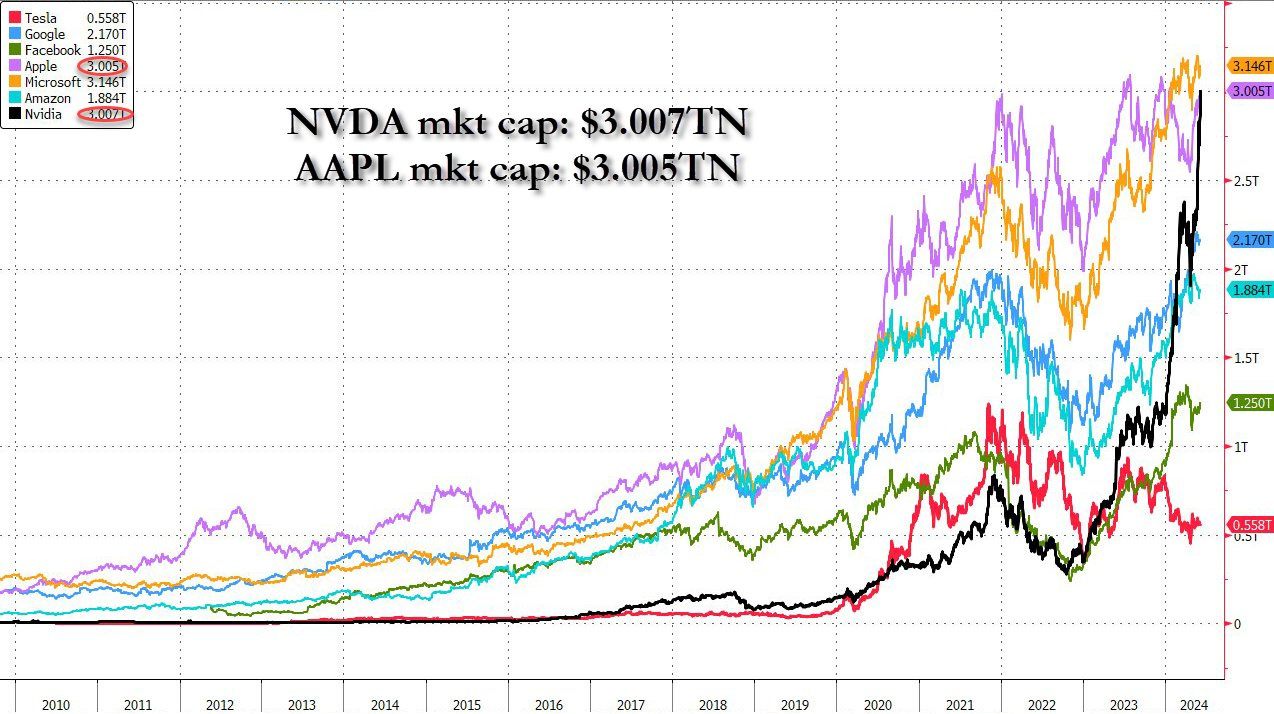

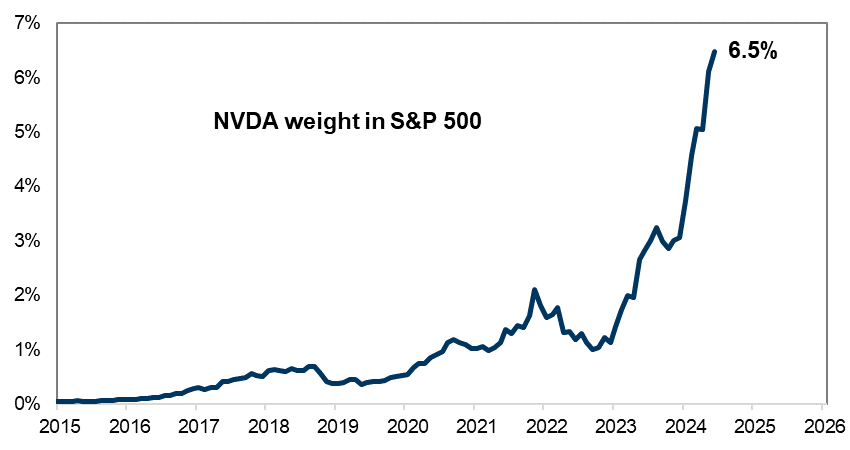

As of yesterday, Nvidia has surpassed Apple as the world’s second largest company, trading above a $3 trillion valuation and now single-handedly accounting for 6.5% of the S&P 500's weight. This chart from Zero Hedge shows Nvidia in black:

Source: Zero Hedge

Nvidia CEO Jensen Huang signing the tits of a perky female “fan” at a booth at Computex, a computer expo held annually in Taipei, Taiwan days ago should have been our clue: animal spirits - of one type of the other - continue to drive the market.

She must really like semiconductors. Here’s a follow up photo for forensic analysis:

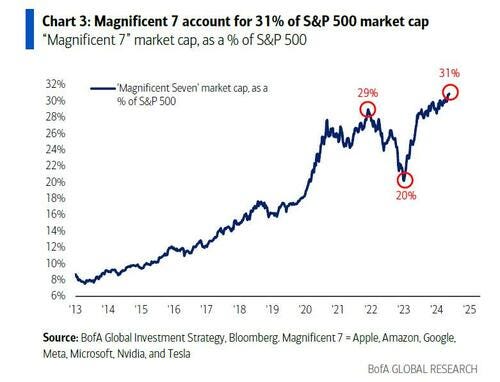

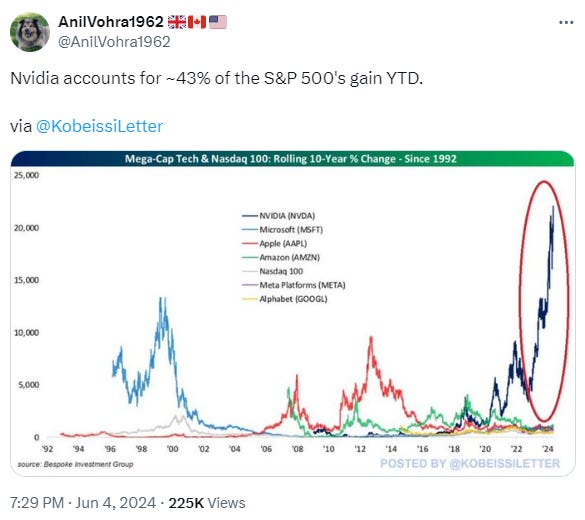

If Nvidia’s colossal weighting as a percentage of the S&P 500 (just think, one of the 500 stocks in the index makes up 6.5% of the index, leaving an average of a 0.2% weighting for the other 499 names) wasn’t enough of a clue, or if you’ve missed the last year of financial commentators opining about the importance of the “Magnificent Seven,” let me sum it up: the market is being driven by a handful of stocks at best, and now, one stock, at worst.

Market breadth is the worst its been since March 2009, Zero Hedge wrote last week, confirming that fewer stocks are responsible for the upward index moves:

Source: Zero Hedge, Michael Hartnett, B of A CIO

Heading into the last few Nvidia earnings reports, sentiment all over social media was that the company's report was single-handedly going to drive the entire stock market's reaction the next day, the next week, the next month and the next quarter. At least for the time being, that looks like it is going to continue to be the case.

Nvidia is the stock market right now. And it is tearing ass higher.

This is great news when a company is on the cusp of new innovation and is driving a major secular trend in a bull market. It means they are doing the heavy lifting for all of the other companies that are underperforming in the same indices as them.

But it also can become an inordinate risk.

Not only does Nvidia's sway over the entire market strike me as having concentration risk, but it also comes at possibly the worst time for today’s stock market.

If you believe, like I do, that the market is simply waiting for a massive reality check that has already started to make its way through the bowels of our economy in the form of higher interest rates, less discretionary spending, and a coming tidal wave of delinquencies and defaults as the consumer runs out of savings and racks up record debt, it becomes evident that Nvidia could wind up being the fuse of a market-wide timebomb.

At 68x trailing earnings, 44x forward earnings and 36.4x sales and an EV/EBITDA of 56.1x, the market has ascribed quite the aggressive valuation to the name. That valuation means the market has set certain lofty expectations for Nvidia.

🔥 40% OFF FOR LIFE: Using this coupon entitles you to 40% off an annual subscription to Fringe Finance for as long as you wish to remain a subscriber.

First, Nvidia owners obviously believe that the company is going to single-handedly drive the artificial intelligence revolution that we are on the cusp of. Sir John Templeton once said about electricity:

“The world would never be the same. Electricity was going to change everything. They were right. It did change everything, but the time to get out of electricity stocks was 1910.”

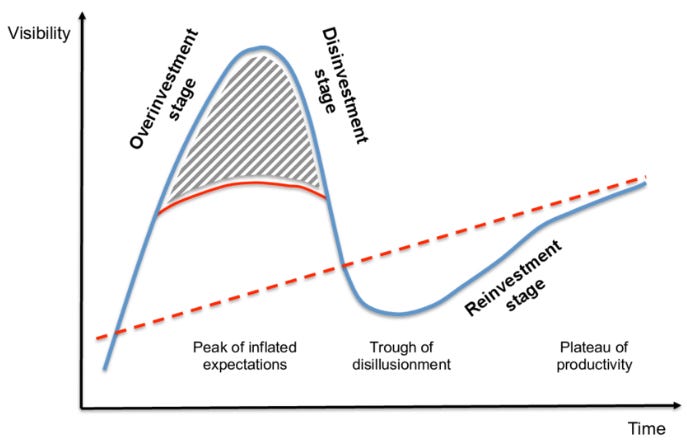

The point is that sometimes the hype can get ahead of the actual runway for growth. Artificial intelligence may be here with us for a while, and this may very well be the beginning of a secular trend, but the rush to pin all of its benefits on the stock of Nvidia may be pricing in too many years of growth occurring too quickly for an industry where competition is going to grow excessively.

Where would you pin AI growth expectations versus reality on a chart like this?

Let’s use Tesla as another analogue. Tesla got all of the electric vehicle premium from the stock market several years back because everybody thought that they were the only company that would make electric vehicles. They were synonymous with electric vehicles in the way that Nvidia is synonymous with artificial intelligence right now.

Today, Tesla is 57.3% lower than its all time high.

What happened? Eventually, General Motors, Volkswagen, Stellantis, and a number of companies all emerged, rather quickly, to provide Tesla with competition.

Now, not only is Tesla not the sole beneficiary of the electric vehicle market, but the entire EV market has become supersaturated, leading many manufacturers to reduce investment and revert back to hybrids.

In other words, the market valuation of Tesla far outpaced where it should have been, and got far ahead of where it may ever return to, if my predictions are correct.

Similarly, it may look like Nvidia will be the only chip running at the heart and soul of any and all artificial intelligence projects going forward, but it simply isn’t going to be the case. In the future, there is going to be semiconductor competition specifically for artificial intelligence, meaning it is worth keeping an eye on exactly how aggressively valued Nvidia becomes.

Ignore the sell side bullshitters. They all want to do investment banking business with Nvidia so they won’t say a bad word about them. Literally everybody on the street and financial media right now wants you to believe that there isn’t a valuation that the company can’t fulfill with future AI demand right now.

But like every darling company does, someday the difference between actual demand and expectations will close and the air pocket baked into Nvidia’s valuation will start to collapse, like we’re seeing with Tesla. And, with the entire stock market tied to Nvidia now, something as simple as a 5% or 10% correction lower as a result of such an air pocket could be devastating for the overall market.

For now and in the short term, at least, it doesn’t look like it’s going to happen. Nvidia has outperformed all expectations in recent earnings reports, and there are no indications that the momentum is going to stop.

But remind yourself: there are always critical questions and “blind spots” to keep an eye on with such a company that moves so fast. One such question has surrounded Nvidia’s relationship with one key customer, Core Weave. You can familiarize yourself with Nvidia’s interesting relationship with one of its key customers in this excellent writeup by FT.

This reminds me: anytime public companies have large customers that account for a material part of their business, they often disclose it in filings as customer concentration risk. Meaning that if we lose this one customer, the effects on the business could be devastating. If the S&P 500 was a corporation, it would now have to disclose Nvidia as part of its concentration risk. If the S&P 500 loses the momentum of Nvidia, it could be devastating for the overall index.

Source: Zero Hedge on X

With interest rates still at 5.5%, it’s not going to take much to send this market off the edge. And now, it isn’t just the economy that is a risk factor for all market participants, it is Nvidia’s stunning performance, too.

When I look for signs of a bubble somewhere, I look for euphoria and unbridled optimism. Like many people noted over the last week, I can’t remember a time in recent history where the chief executive officer of a public company was asked to sign autographs.

The last time I remember this happening was the executives at Herbalife signing autographs at one of their "extravaganza events."

That company, which literally relied on hype to sell its business opportunity, is down -79.7% in the last 3 years and is trading about -81% from its all time highs.

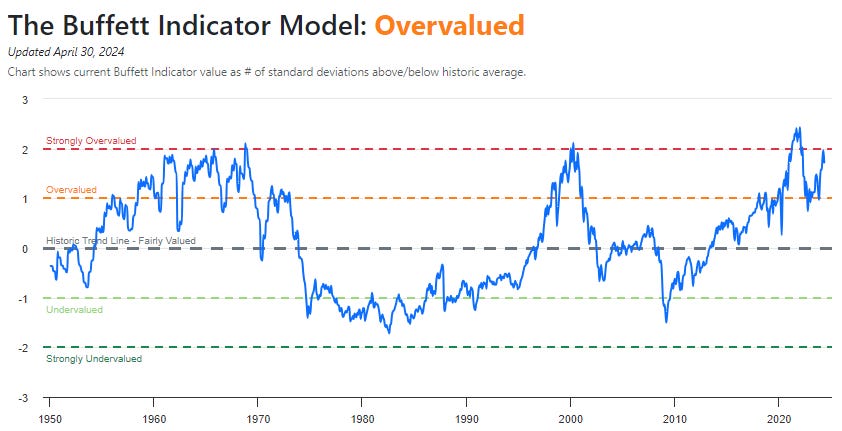

It’s not going to be a surprise to my readers that I think the market is overvalued and that the delta between the sky-high valuations in stocks and the economic reality of what higher interest rates are doing on the ground, has reached its widest point yet.

This means I believe the market, today, is at its highest chance of a sharp move lower than it has ever been at in recent history. Here’s a glimpse of where we stand today:

The truth is that animal spirits in the stock market have been dying over the last two years, despite stocks moving to all time highs, driven by bullishness in a small group of select names.

High interest rates kill animal spirits and Nvidia is running on animal spirits. High rates force people to think about tightening their belts and spending less while reducing their leverage, raising cash, and preparing for, then riding out, price deflation. The fact that the remaining, dwindling animal spirits in the market have now all concentrated themselves into one name, Nvidia, in my opinion, only adds more significant risk of an overall broader market correction.

“Don’t put all your eggs in one basket,” has been a saying for a trillion years for good reason. I would not want to be long technology stocks, the NASDAQ index, the S&P 500, or Nvidia at these levels. As I said in my "24 Stocks to Watch for 2024" at the beginning of the year, I still believe we are going to see a heavy rotation out of overvalued tech names and into things like utilities, consumer staples, and defense stocks heading into 2025. I believe that is going to come as a market decline takes place.

We can run, we can hide, we can bamboozle our economic data, and we can put lipstick on this pig for as long as we want to try to, but at the end of the day, the simple math and economics behind 5.5% interest rates are going to rule the day, and this market is going to have to correct. The only question to me now is whether it will be economic forces or Nvidia that sets off the selling.

QTR’s Disclaimer: Please read my full legal disclaimer on my About page here. This post represents my opinions only. In addition, please understand I am an idiot and often get things wrong and lose money. I may own or transact in any names mentioned in this piece at any time without warning. Contributor posts and aggregated posts have been hand selected by me, have not been fact checked and are the opinions of their authors. They are either submitted to QTR by their author, reprinted under a Creative Commons license with my best effort to uphold what the license asks, or with the permission of the author. This is not a recommendation to buy or sell any stocks or securities, just my opinions. I often lose money on positions I trade/invest in. I may add any name mentioned in this article and sell any name mentioned in this piece at any time, without further warning. None of this is a solicitation to buy or sell securities. These positions can change immediately as soon as I publish this, with or without notice. You are on your own. Do not make decisions based on my blog. I exist on the fringe. The publisher does not guarantee the accuracy or completeness of the information provided in this page. These are not the opinions of any of my employers, partners, or associates. I did my best to be honest about my disclosures but can’t guarantee I am right; I write these posts after a couple beers sometimes. I edit after my posts are published because I’m impatient and lazy, so if you see a typo, check back in a half hour. Also, I just straight up get shit wrong a lot. I mention it twice because it’s that important.

Source link