On a day when the jobs report was a "pick your adventure" in economic analysis, and signaled either a very strong job market (if you looked at the Establishment survey) or a dire one (if you looked at the Household survey and peaked even a bit below the surface), moments ago we got the tie-breaker in the form of the latest Consumer credit data, and it confirmed our fears: the consumer has hit a brick wall.

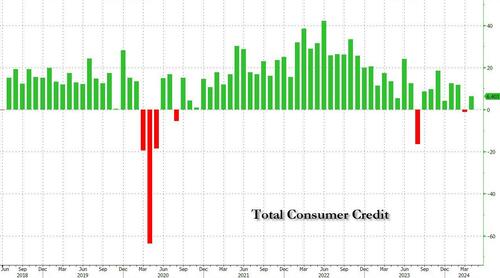

According to the Federal Reserve's monthly consumer credit report, in April total consumer credit rose $6.4 billion, far below the median estimate of $10 billion, but more notably, the March number was shocking revised from $6.3BN to a negative $1.1BN, the biggest drop since last August when Biden enacted his unconstitutional student debt relief.

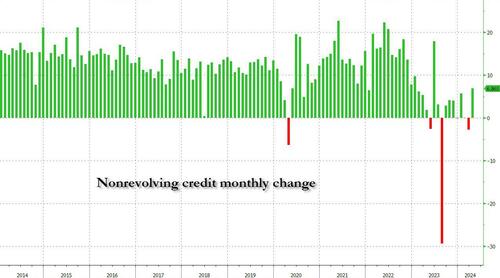

And while the reason behind the dramatic revision to the March print was due to a plunge in non-revolving credit, the result of even more student debt cancellations which however were only apparent in retrospect, with April reverting somewhat back to normal at $6.9 billion, if well below the recent monthly average of $12 billion...

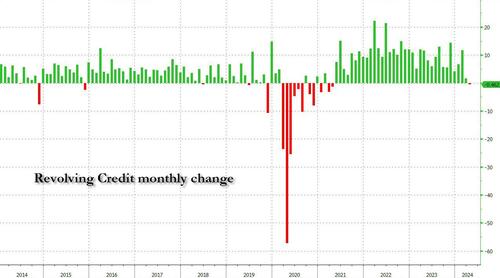

... what was the real shocker in today's print was the April revolving credit print, i.e., credit card debt. At -$0.5BN, it followed last month's puny $1.7BN, and was the first negative number since the covid crisis!

To get a sense just how rare it is to get a negative credit card debt monthly change, consider that in the six years prior to the covid crash, the US had recorded just 5 months of negative prints, and all tended to precede major drawdowns in the economy. We expect no less this time.

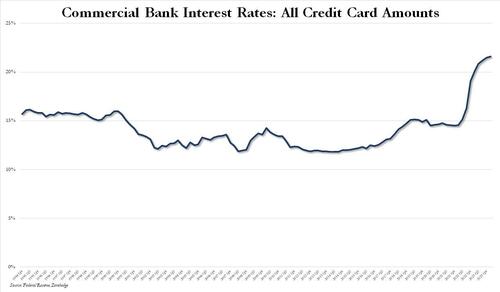

Of course with the Fed refusing to cut rates - for good reason - the brutal slowdown in new credit card debt is hardly a surprise because in Q1 the average rate across all commercial banks on all credit card amounts just hit a new record high of 21.59%, which is a vivid reminder that while banks are happy to hike credit card rates, they rarely if ever cut them, and it's also one of the main reasons why Goldman's trading desk just went bearish on US consumers.

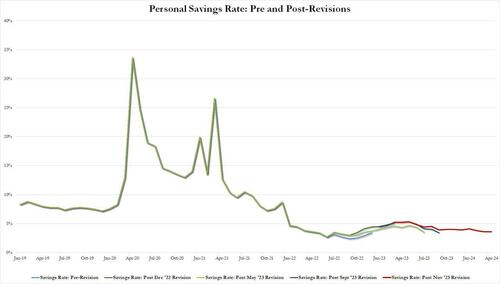

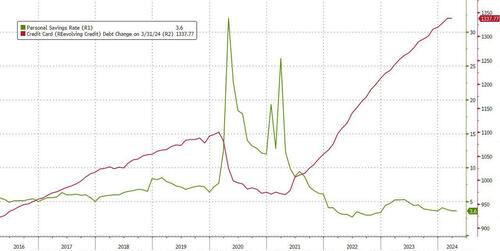

Yet with consumers ever more strapped for actual cash and equity, as the personal savings rate in the US has collapsed from over 5% to 3.6% - the lowest since 2022 - in just a few months...

... there is only so much more credit card maxing out that can take place before reality finally sets in, as can be seen in the next and perhaps most striking chart yet: total credit card debt is record high while the personal savings rate is record low!

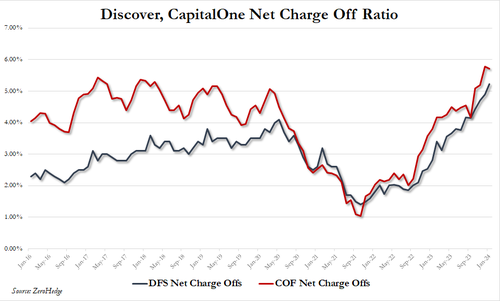

Then again, with an election on the horizon - one which ensures that any credit-card fueled spending must be encouraged - don't be surprised if the White House instructs banks to just ignore soaring delinquency and charge-off rates...

... as discussed previously in "These Are The 5 Charts The FDIC Does Not Want You Paying Attention To", only for the hammer to fall on the first day of Trump's new presidency.

Source link